Nature4Climate released its third nature tech market report live at Bloom 23, Lucy Almond presented the report findings, reviewing the market’s size, investment stages, and emerging trends and answering burning questions around risk and accurate impact measurements.

The nature tech report released at Bloom 23 was prepared by Nature4Climate, the MRV Collective, and Serena Capital. Bloom is a conference for professionals and leaders creating strategies for the protection and regeneration of nature; a forum for pioneers to present their findings and examples of high-impact nature tech applications.

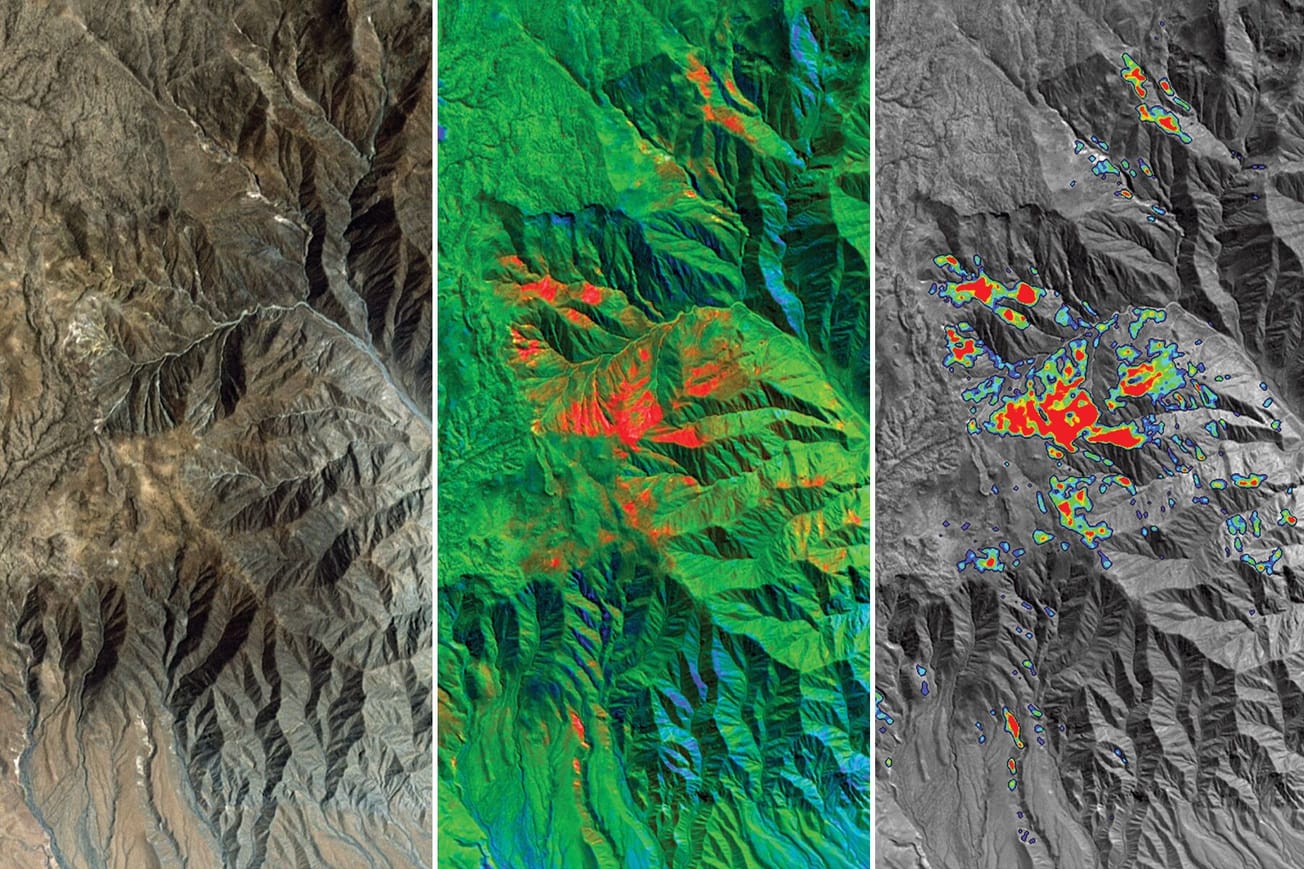

The field of ‘monitoring, reporting and verification’ (MRV) is of fundamental importance, as robust MRV provides project developers, investors, and financial institutions with confidence that impacts have been properly and rigorously considered.

—Nature4Climate

Almond said the new report expands the definition of nature tech from a more narrow tech perspective to a broad range of environmental challenges such as deforestation, soil degradation, water pollution, and species loss, all categorized into seven areas now attracting investment and demand. Nature tech is now breaking away as a standalone category from climate tech with $7.5 billion in VC investments over the last five years.

Venture capital (VC) investments in nature tech startups have been developing quickly over the past three years: early-stage deals rose by 130% between 2020 and 2022 and average deal sizes for seed to series B funding increased by 70%, demonstrating the growing maturity of the nature tech industry.

—Nature4Climate

Tune in to the Bloom 23 nature tech keynote for more information on specific examples, demand for new tools, and to hear more on areas attracting investment.